Modern users are less and less willing to put up with inconvenient services. This is especially true in the financial sector, where every minute, every action, and every button matters. Today, you can't just rely on deposit interest or the breadth of your product line. The winner is the one who makes the process of communicating with the bank simple, understandable and even pleasant. That's why more and more experts, products, and strategists are raising the issue: why it's important for banks to invest in UX.

Let's go through the steps like qualitative user experience affects the business of banks and how it is implemented by financial companies in Russia. CIS countries.

UX as a way to talk to the client without words

When a user opens a banking app or visits a website, they don't read press releases or listen to statements from top managers. It interacts with the product. This is the language in which the bank communicates with the client.

If the interface is overloaded, navigation is difficult, and banal operations take a long time — this is a signal. And not only about bad design, but also about indifference. The client concludes: "If I'm not comfortable here, I'm not welcome here."

And vice versa: a clear interface, logical navigation, intuitive system behavior-all this says: "We took care of you."

Everyday experience is more important than advertising promises

UX doesn't end on the screen. This includes the operation of ATMs, the behavior of push notifications, and how quickly online accounts are opened. When a client needs to transfer money urgently, but the app freezes or requires you to enter unnecessary data, this creates tension.

Hence the growing distrust and emotional rejection. While a well-built UX helps avoid these annoying factors and creates a positive attitude towards the bank.

Evidence through practice: cases from the CIS

Kazakhstan

One of the largest banks in the country has redesigned the mobile app, focusing on the speed of operations. Instead of complex screens with a lot of fields — three steps to translation, with saved templates and the "search by phone number" function. The result is an increase in user activity in the app and a reduction in the load on the call center.

Uzbekistan

The Bank has implemented a visual language in online banking: color coding of transactions, visual graphs, separation of personal and business accounts. This greatly simplified the work for entrepreneurs. Instead of calling tech support — you can simply switch between sections and get hints at the right moment.

Belarus

The financial institution focused on redesigning the system for the older generation. Fonts are enlarged, unnecessary animations are removed, voice prompts and step-by-step instructions are added. The bank received thanks from thousands of users over the age of 55 — and this was reflected in the overall growth of user loyalty.

Russia

One of the largest players conducted an audit of digital channels and in the course of a UX study revealed that customers are lost when opening an investment account. After optimizing the funnel and implementing interactive tips, the conversion rate increased significantly. At the same time, support costs related to investments decreased.

UX research: not a fashion, but a necessity

To make interfaces user-friendly, it is not enough to have an aesthetically pleasing design. It is important to monitor user behavior, ask the right questions, and run tests. Research, in-depth interviews, click maps, and user path analysis are methods that help you understand where the client gets lost, where they get annoyed,and where they stop.

The collected information helps you not just "paint buttons", but build a real interaction architecture. This is a job that requires attention and commitment, but the result is felt not only in reviews — it is measurable in numbers.

Competition is now not with banks, but with services

A person who is used to the convenience of taxi services, food, subscriptions, and marketplaces will not make allowances for the banking sector. It expects the same level of simplicity. If the food delivery app allows you to place an order in 30 seconds — why should the payment between your invoices take longer?

The winner is the one who is comparable in experience not only with other banks, but also with leaders in the digital environment. Here, UX becomes a way to stay in tune with the client's life.

The trend towards minimalism and "invisible technology"

Banking UX is increasingly moving towards invisibility. This doesn't mean it disappears — it just doesn't get in the way. The fewer actions needed for the result, the better. The goal is to make the process as clear as possible, reduce the cognitive load and remove all unnecessary things.

That is why many banks abandon complex dashboards, leaving only the most necessary things. Automatic payment detection, reminders, and predictive search-all this makes the user path easier, which means it increases engagement.

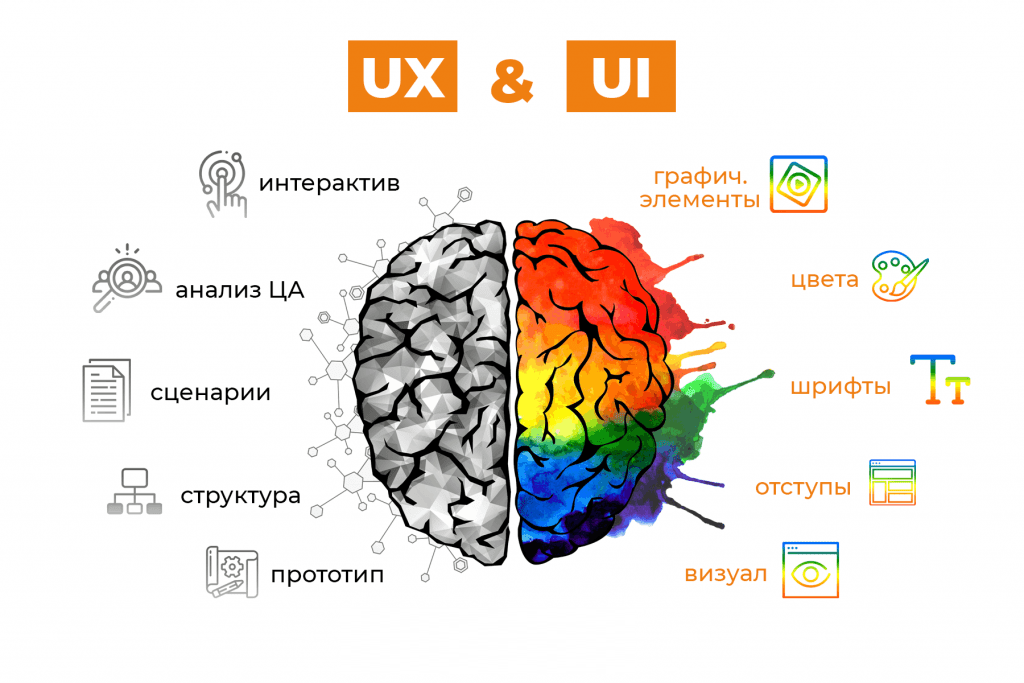

UX is not just about design

It should be understood: UX is not the work of one designer. This is a well-coordinated work of the team: analysts, product scientists, marketers, developers. How flexible and responsive the team will be depends on how quickly you can adapt to new user habits.

In addition, UX directly affects the bank's internal processes. A well-built digital client path reduces support requests, reduces the burden on offices, and improves the bank's reputation.

Why it's important for banks to invest in UX: bottom line

When we talk about, why it's important for banks to invest in UXwe do not mean just the interface, but the entire experience of customer interaction with the bank. These are emotions, speed, simplicity, and care. This is what creates trust and the desire to stay.

The financial sector will always be conservative in nature — stability is important in it. But it is UX that allows you to combine this stability with comfort and adaptation to the user's life. And banks that pay attention to the customer experience today will receive not only more profit tomorrow, but also sincere loyalty.